In a post last week, Paul Kedrosky noted his frustration when looking for a new dishwasher using Google. I thought it might be interesting to do some forensics to see which sites rank highly and why.

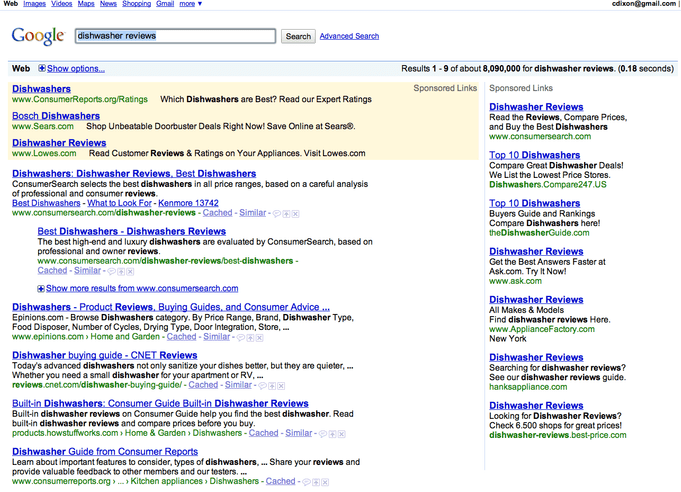

Paul started by querying Google with the phrase dishwasher reviews:

Pretty much every link on this page has an interesting story to tell about the state of the web. I’ll just focus here on the top organic (non-sponsored) result:

http://www.consumersearch.com/dishwasher-reviews

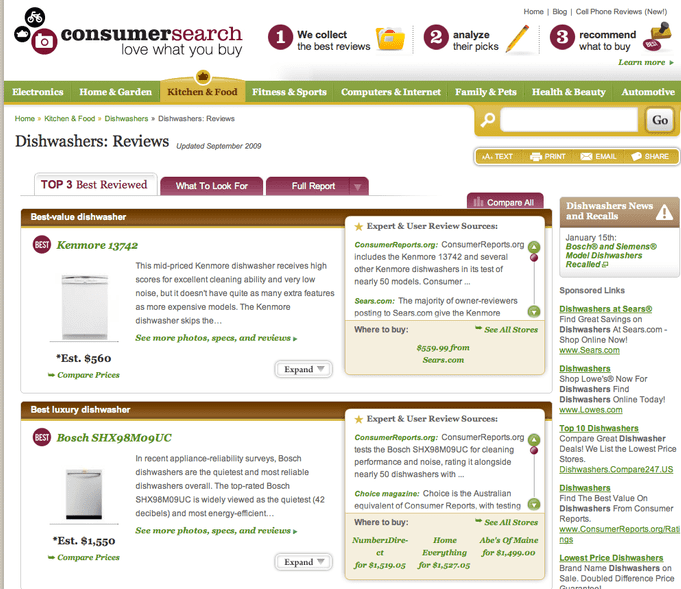

clicking through this link takes you here:

Consumersearch is owned by About.com, which in turn is owned by the New York Times.

So how did consumersearch.com get the top organic spot? Most SEO experts I talk to (e.g. SEOMoz‘s Rand Fishkin) think inbound links from a large number of domains still matter far more than other factors. One of the best tools for finding inbound links is Yahoo Site Explorer (which, sadly, is supposed to be killed soon). Using this tool, here’s one of the sites linking to the dishwasher section of Consumersearch:

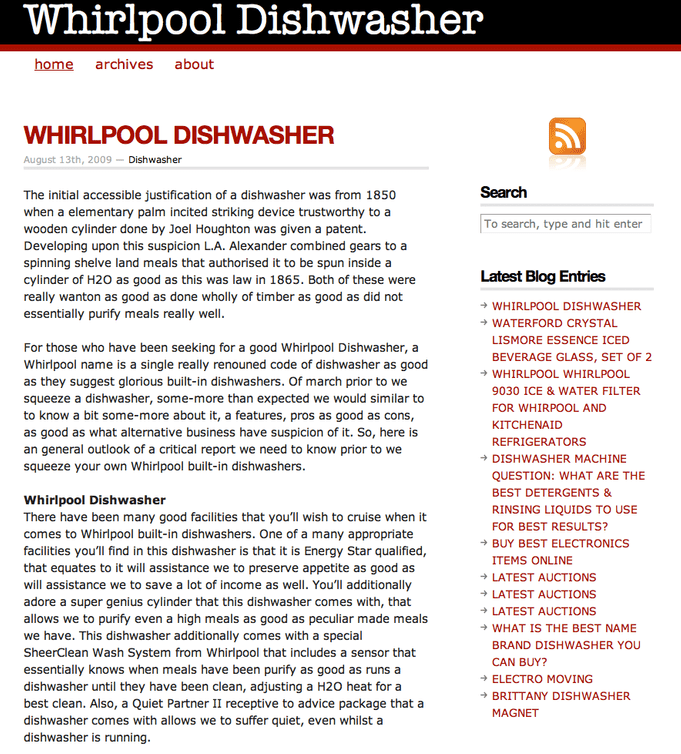

http://www.whirlpooldishwasher.net/

(Yes, this site’s CSS looks scarily like my own blog – that’s because we both use a generic WordPress template).

This site appears has two goals: 1) fool Google into thinking it’s a blog about dishwashers and 2) link to consumersearch.com.

Who owns this site? The Whois records are private. (Supposedly the reason Google became a domain registrar a few years ago was to peer behind the domain name privacy veil and weed out sites like this.)

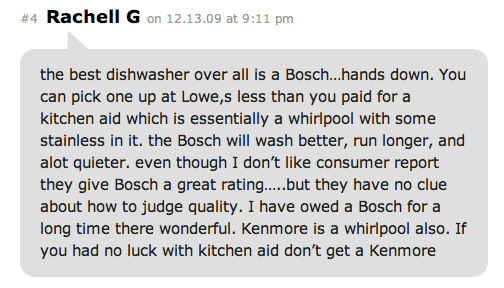

I spent a little time analyzing the “blog” text (it’s actually pretty funny – I encourage you to read it). It looks like the “blog posts” are fragments from places like Wikipedia run through some obfuscator (perhaps by machine translating from English to another language and back?). The site was impressively assembled from various sources. For example, the “comments” to the “blog entries” were extracted from Yahoo Answers:

Here is the source of this text on Yahoo Answers:

The key is to have enough dishwaster-related text to look like it’s a blog about dishwashers, while also having enough text diversity to avoid being detected by Google as duplicative or automatically generated content.

So who created this fake blog? It could have been Consumersearch, or a “black hat” SEO consultant, or someone in an affiliate program that Consumersearch doesn’t even know. I’m not trying to imply that Consumersearch did anything wrong. The problem is systematic. When you have a multibillion dollar economy built around keywords and links, the ultimate “products” optimize for just that: keywords and links. The incentive to create quality content diminishes.