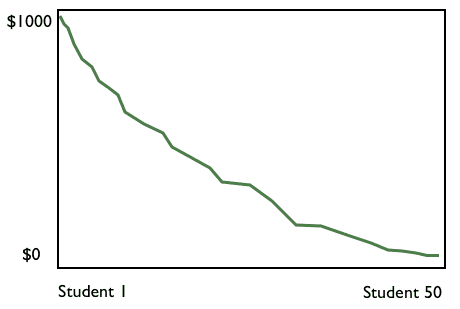

Many college microeconomics courses include the following exercise. The teacher offers the students an imaginary trip to Hawaii, and asks them to write down on notecards how much they are willing to pay for the trip. The teacher takes the notecards and graphs the bids. Here’s how the graph might look:

The y-axis is the students’ “willingness-to-pay” and the x-axis is the students sorted from highest to lowest bids. The line is known as the demand curve.

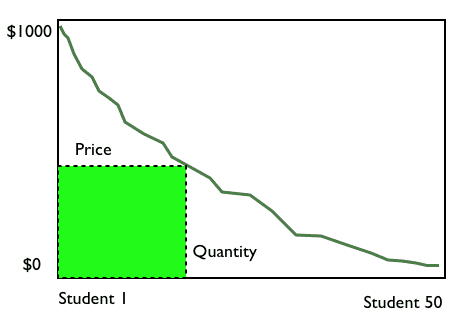

Now imagine you’re the company selling these trips. For simplicity, suppose you’ve already bought the trips, so your marginal cost is zero. What’s the optimal price you should charge? If you set the price at, say, $500, then the students who are willing to pay above $500 would buy the trip, and the rest wouldn’t:

Your total revenue and (assuming zero marginal cost) profit will be the area of the green square (revenue times quantity).

Notice the sections under the curve to the right and above the green box. To the right are students who were willing to pay but were priced out. Those are missed sales opportunities. Above the green box are students who were willing to pay more than you charged. That is lost revenue. (Since the underpricing benefits customers, the area above the green box is called the consumer surplus).

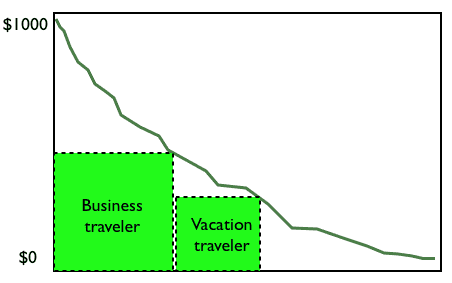

After you have chosen the right price, the only way to make the area under the curve greener is to charge different customers different prices. The theoretically optimal way to do this is to look at each notecard and offer to charge each student, say, 10% less than the prices he or she bid. In real life you can’t do this (although Priceline has gotten close by asking customers to enter their willingness to pay). Some companies – most famously Amazon - have attempted outright price discrimination, but this tends to anger customers and can even run afoul of the law.

So the goal of pricing is to capture as much area under the demand curve as possible. In practice, the best way to do this is to find proxies for willingness-to-pay that are easy to observe and that customers will accept.

For example, airlines know that business customers will pay more than vacation travelers. They therefore look for acceptable proxies to segment business and vacation travelers and capture more of the area under the demand curve.

This is why flights are cheaper when you book early, stay over on weekends etc. The airline pricing models assume you are a vacation traveller.

Book publishers would like to price their books according to customer enthusiasm. Hardcore fans will pay more for books when they are first published, and casual readers will wait. If publishers offer the same book at different prices at different times, their price discrimination will be too obvious (interestingly, time windowing for movies doesn’t provoke much outrage). So book publishers offer modestly better goods – hardcovers – to early buyers.

Enterprise software companies price using proxies for the customer’s budget. Oracle databases are priced by the number of processors. Salesforce is priced by the number of end users (“seats”). Many enterprise software companies obfuscate the highest tier of pricing, telling sales prospects at that level to “call us.” What this really means is: “Call us, so our sales people can attempt to estimate your budget and price discriminate accordingly.”

Sometimes, the search for pricing proxies can lead to absurdity. I once heard someone from a prominent hardware company tell a story about how his company had offered two versions of a printer. The cheaper model was identical to the more expensive one, except the cheaper one printed fewer pages per minute. To accomplish this, the cheaper printer had the same hardware as the expensive one, except the cheaper one had an additional chip that forced it to slow down. This made the cheaper printer more expensive to produce. Situations where cost and price have zero or negative correlation are far more common than most people assume.