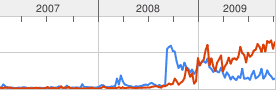

People who criticize Obama’s economic policies forget that, around the beginning of this year, a lot of serious people thought we were entering a second Great Depression. Here are the Google News mentions of the words “Great Depression” (in blue) and “economic recovery” (in red) over the last three years:

Moreover, most experts thought we were being led into a Great Depression not by “fundamentals” but by the collapse of the financial system.

Back around when Obama proposed his bank bailout plan (which was mostly an extension of Bush and Bernanke’s plan) he was widely criticized. The consensus criticism was succinctly summarized by Nobel Laureate Joseph Steiglitz:

Paying fair market values for the assets will not work. Only by overpaying for the assets will the banks be adequately recapitalized. But overpaying for the assets simply shifts the losses to the government. In other words, the Geithner plan works only if and when the taxpayer loses big time.

Around this time, I happened to bump into an old friend who was working at a hedge fund where his full-time job was trading these so-called toxic assets (CDSs, CDOs, etc). I asked him the trillion dollar question: what did he think the “fair market value” for these assets was? Were they worth, say, 80 cents on the dollar as the banks were claiming, or 20 cents on the dollar as the bidders in the market were offering.

His answer: These assets are essentially bets on home mortgages, which in turn are dependent on housing prices, which in turn are dependent on the economy, which in turn is highly dependent on whether the banks stay solvent, which is dependent on what these assets are worth.

This circularity is not unique to these particular assets. As George Soros has argued for decades, all economic systems are profoundly circular, a property that he calls reflexivity.

The bank bailouts were extremely distasteful in many ways. Lots of underserving people got rich. Institutions that should have failed didn’t. Dangerous “moral hazard” precedents were set. But the fact remains: by altering perceptions, the Bush/Obama/Bernanke plan seems to have turned the second Great Depression into “merely” a bad recession.

The Dow passed the symbolic milestone of 10,000 recently. People who say it’s an illusion and doesn’t reflect economic fundamentals don’t understand that in economics, perception and fundamentals are inextricably linked.