[

](images/screen-shot-2009-12-27-at-11-51-18-am.png)

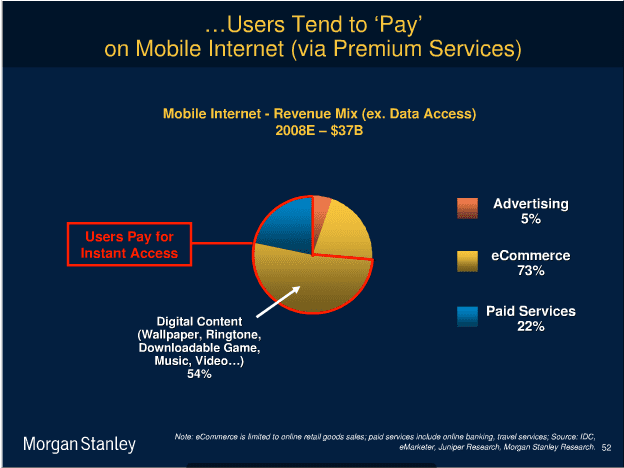

The assertion seems to be that there is something special about the mobile internet that compels people to pay for things they wouldn’t pay for on the desktop internet. It is this same thinking that has newspapers and magazines hoping the Kindle or a tablet device might be their savior.

It is certainly true that today people are paying for things on iPhones and Kindles that they aren’t paying for on the desktop internet. Personally, I’ve bought a bunch of iPhone games that I would have expected to get for free online. I also paid for the New York Times and some magazines on my Kindle that I never paid for on my desktop.

But longer term, the question is whether this is because of something fundamentally – and sustainably – different about mobile versus desktop or whether it is just good old fashioned supply and demand.

I think we are in the AOL “walled garden” days of the mobile internet. Demand is far outpacing supply, so consumers are paying for digital goods. I don’t pay for news or simple games on the desktop internet because there are so many substitutes that my willingness to pay is driven down to zero.

What are the arguments that the mobile internet is sustainably different than the desktop internet? One of the main ones I’ve heard is habit: digital goods providers made a mistake in the 90′s by giving stuff away for free. Now people are habituated to free stuff on the desktop internet. Mobile is a chance to start over.

I think this habit argument is greatly overplayed. The same argument has been made for years by the music industry: “kids today think music should be free” and so on. Back in the 90s, I bought CDs, not because I was habituated to paying for music, but because there was no other reasonably convenient way to get it. If tomorrow you waved a magic wand and CD’s were once again the only way kids could buy the Jonas Brothers and Taylor Swift, they’d pay for them. It’s the fact that there are convenient and free substitutes that’s killing the music industry, not consumers’ habits.

As the supply of mobile digital goods grows — the same way it did on the desktop internet — consumers’ willingness-to-pay will drop and either advertising will emerge as the key driver of mobile economic growth or the mobile economy will disappoint. I was going to buy a Chess app for my iPhone this morning but when I searched and found dozens of free ones I downloaded one of those. At some point there will be lots of Tweetie, Red Laser, and Flight Control substitutes and they too will be free.