Today we are announcing that A16z is leading a $40M investment in Stack Exchange, along with earlier investors USV, Bezos Expeditions, Spark, and Index.

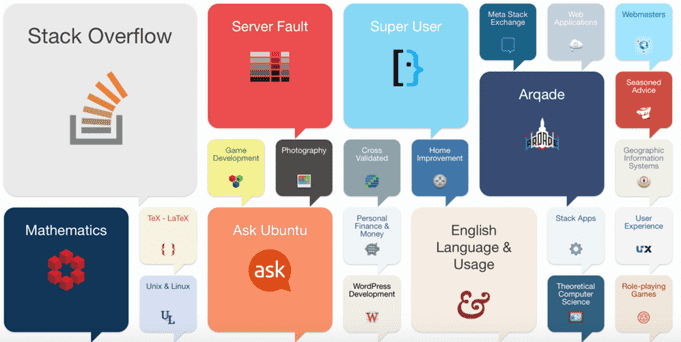

Stack Exchange is a network of 133 sites (and growing) where people can ask and answer questions about topics related to engineering, science, hobbies, and more. The biggest site on the network is Stack Overflow, which alone gets over 40 million unique visitors per month. The other sites cover a very wide variety of topics, including: math, gardening, English language usage, graphic design, physics, cryptography, chess, astronomy, Buddhism, data science, martial arts, home improvement, photography, bicycles, board games, economics, to name a few. Most likely, you’ve used Stack Exchange without even knowing it —the network had over 300M unique visitors last year. Many users come in through Google, get their answer, and then leave, usually a little bit smarter.

One of the major startup opportunities of the information age is: now that more than two billion people have internet-connected devices, how do we create systems to efficiently share and store their collective knowledge? Requirements for successful collective knowledge systems include: 1) users need to be given the proper incentives to contribute, 2) the contributions of helpful users need to make the system smarter (not just bigger), and 3) users with malicious intent can’t be allowed to hurt the system.

Many entrepreneurs and inventors have tried and failed to solve this problem. As far as I know, only two organizations have succeeded at scale: Stack Exchange and Wikipedia. Stack isn’t as large as Wikipedia on the readership side — the topics are more specialized—but, on the contributor side, is closely comparable to Wikipedia. Last year, Stack had over 300 million unique visitors, and 3.8 million total registered users, who contributed over 3.1M questions, 4.5M answers, 2.7M edits, and 17M comments.

Stack’s business model is based on job placement. Employers create company pages (here is Amazon’s—over 6000 companies have created pages) and then run targeted ad campaigns for open job opportunities. Revenue has grown quickly, and the company employs over 200 people. The HQ is in NYC, with offices in Denver and London, and remote workers in Israel, Brazil, Japan, Germany, Slovenia, France, and across the US.

I believe Stack Exchange’s growth has now reached escape velocity. Not only will the existing topics continue to grow, but many new topics will emerge, until the network covers every topic that is amenable to objective Q&A. As new generations of people grow up on the internet, old habits — searching through textbooks or how-to books, or asking friends—will fade away. People will come to expect that any objective question can be instantly answered with a Google search.

I’ve been a personal investor in Stack since its initial funding, and it has always been one of my favorite investments. Stack’s cofounder & CEO, Joel Spolsky, is an amazing entrepreneur and internet visionary. I’m very happy to back him again with this new investment.