Paul Kedrosky recently speculated that there might be seed fund “crash” looming. Liz Gannes followed up by suggesting seed investors are a fad akin to reality-TV celebrities:

In many ways, what [prominent seed funds] are saying is that they’re just smarter, and as such will outlast all the copycat and wannabe seed funders as well as the stale VCs with a fresh coat of paint. But then — Kim Kardashian is the only one who can make a living tweeting. At some point it will be quite obvious whether the super angels’ investments and strategy succeed or fail.

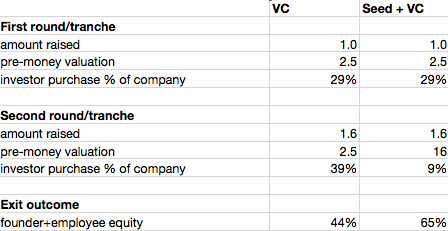

Here’s the key point these analyses overlook: It’s not the seed investors who are smarter – it’s the entrepreneurs. Consider the case of the last company I co-founded, SiteAdvisor. We raised our first round of $2.6M at a $2.5M pre-money valuation. After the first round of funding, investors owned 56% of the company. Moreover, the $2.6M came in 3 tranches: $500K, another $500K, and then $1.6K. To get the 2nd and 3rd tranches we had to hit predefined milestones and re-pitch the VC partnerships. Had we instead raised the first $1M from seed funds, we would have been free to raise the remaining money at a higher valuation. In fact, after we spent less than $1M building the product, we raised more money at a $16M pre-money valuation. We never even touched the $1.6M third tranche even though it caused us to take significant dilution\. This was a very common occurrence before the rise of seed funds, due to VCs pressuring entrepreneurs to raise more money than they needed so the VCs could “put more money to work.” When SiteAdvisor was eventually acquired, we had spent less than a third of the money we raised. Compare the dilution we actually took to what we could have taken had we raised seed before VC:

Professional seed funds barely existed back then, especially on the East Coast. And even if they did, I’m not sure I would have been savvy enough to opt for them over VCs. I thought the brands of the big VCs would help me and didn’t really understand the dynamics of fund raising.* Today, entrepreneurs are much savvier, thanks to the proliferation of good advice on blogs, via mentorship programs, and a generally more active and connected entrepreneur community. For example, Founder Collective recently backed two Y-Combinator startups who decided to raise money exclusively from seed investors despite having top-tier VCs throwing money at them at higher valuations. These were “hot” companies who had plenty of options but realized they’d take less start-to-exit dilution by raising money from helpful seed investors first and VCs later.

Will there be there a seed fund crash? Seed fund returns are highly correlated with VC returns which are highly correlated with public markets and the overall economy. I have no idea what the state of the overall economy will be over the next few years. Perhaps it will crash and take VCs and seed funds down with it. But I do have strong evidence that prominent seed funds will outperform top-tier VC funds, because I know the details of their investments, and that their portfolios contain the same companies as top-tier VCs except the they invested in earlier rounds at significantly lower valuations. So unless these prominent seed funds were incredibly unlucky picking companies (and since they are extremely diversified I highly doubt that), their returns will significantly beat top-tier VC returns.

* Note that we have nothing but gratitude toward the SiteAdvisor VCs – Rob Stavis at Bessemer and Hemant Taneja at General Catalyst. They offered what was considered a market deal at the time and supported us when (almost) no one else would.