There is a widespread belief in technology circles that bundling of cable TV, newspaper, magazine and other information goods will go away now that those products can be distributed à la carte on the internet. The assumption seems to be that bundling is an artifact of another era when distribution was physical. But this reasoning misses the economic logic behind bundling: under assumptions that apply to most information-based businesses, bundling benefits buyers and sellers.

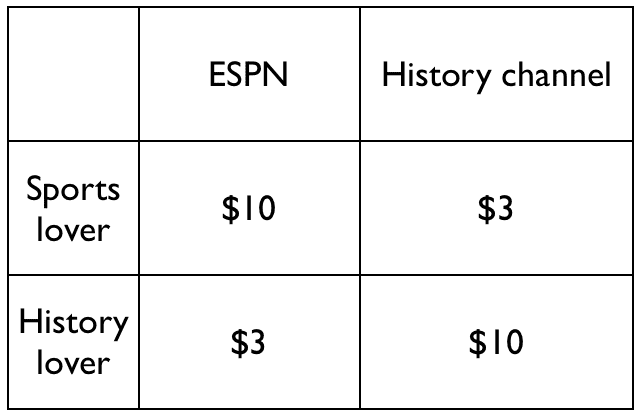

Consider the following simple model for the willingness-to-pay of two cable buyers, the “sports lover” and the “history lover”:

What price should the cable companies charge to maximize revenues? Note that optimal prices are always somewhere below the buyers’ willingness-to-pay. Otherwise the buyer wouldn’t benefit from the purchase. For simplicity, assume prices are set 10% lower than willingness-to-pay. If ESPN and the History Channel were sold individually, the revenue maximizing price would be $9 ($10 with a 10% discount). Sports lovers would buy ESPN and history lovers would buy the History Channel. The cable company would get $18 in revenue.

By bundling channels, the cable company can charge each customer $11.70 ($13 discounted 10%) for the bundle, yielding combined revenue of $23.40. The consumer surplus would be $2 in the non-bundle and $2.60 in the bundle. Thus both buyers and sellers benefit from bundling.

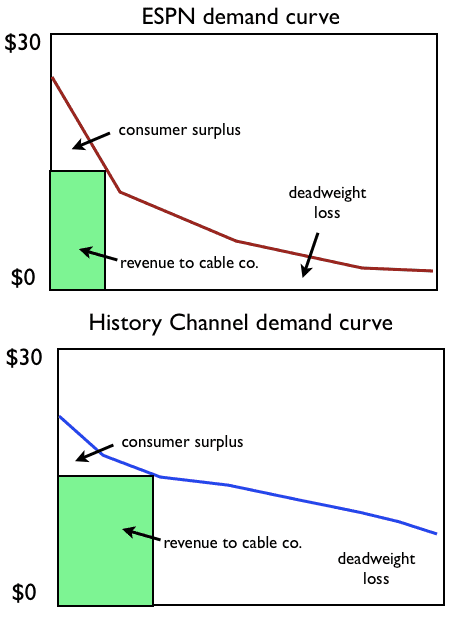

This model is obviously dramatically oversimplified. In real life, bundling tends to flatten the demand curve (here is some background on demand curves, and here is academic paper that presents this argument in rigorous mathematical terms). Suppose the demand curves for ESPN and the History Channel look like this:

The green boxes represent revenue for the seller. The deadweight loss areas to the right of the green boxes are transactions that would have benefited buyers and sellers but are not occurring because the revenue-maximizing prices are set too high.

Now consider what happens when you bundle channels. The key assumption is that individual buyers lie on different x-axis points of the demand curves of different channels. Sports lovers lie on the left of the ESPN demand curve but on the right side of the History Channel curve. To aggregate demand curves, you don’t stack one on top of the other. You add consumers’ willingness-to-pay separately for each channel.

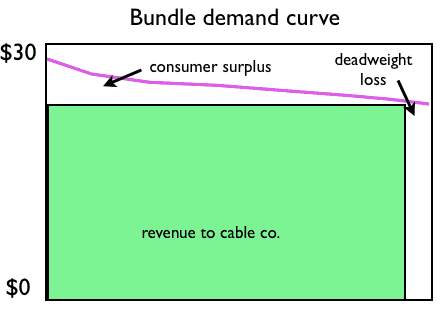

Using the above simplified model, the two demand curves that go from $10 to $3 become one curve that stays flat at $13. In general, adding the individual demand curves creates a flatter demand curve:

A flatter demand curve lets sellers charge prices that capture larger areas under the curve and pass more surplus back to consumers. The only loser is the deadweight loss area.

Some things to note about bundled pricing:

1. Bundled pricing is one reason why subscription models like Spotify should ultimately win out over à la carte models like iTunes. Subscription commerce can also be thought of as a form of bundling.

2. There are other ways to get some of the benefits of bundled pricing – for example versioning goods, and offering bulk discounts.

3. The benefits of bundled pricing are proportionate the buyers’ variance of preferences for the goods. Hence bundled pricing works best in highly “taste-based” goods like media, and wouldn’t have any benefit for fully commoditized goods (e.g. a bundle of stocks)

4. Bundled pricing can also hurt consumers if it is used by incumbents to exploit their broader catalog to “deter entry” by new competitors. This was a common complaint against Microsoft in the 90′s when they bundled applications like Internet Explorer with Windows.