A friend asked me the other day “Which VC firms should I pitch?” and I started to respond to him, but then realized that most of my knowledge of VC firms is already available online in the Which VC firm should I pitch? Hunch decision topic. That is the idea behind Hunch: to crowdsource the creation of decision trees, so that a group of knowledgeable people can get together and create a “virtual expert” that can be accessed by anyone.

Here is the VC chooser topic in embedded widget form (anything you create on Hunch can be embedded anywhere):

Which VC firm should I pitch? – make thousands more decisions on Hunch.com

Like everything on Hunch, this topic is completely user generated (“topic” is our word for what some people would call a “decision tree”). Users have full control over the questions it asks, the results (in this case VC firms), the descriptions, and a lot of more advanced functionality for “sculpting” the decision tree. If you go to the VC topic’s About page you can see that so far 7 people have contributed 86 firms and 5 questions to this topic (other topics have a much wider range of contributers, this one for example). The VC topic has been played (used by non contributors) 506 times, many of those users coming in via Google organic results for phrases related to pitching VC firms.

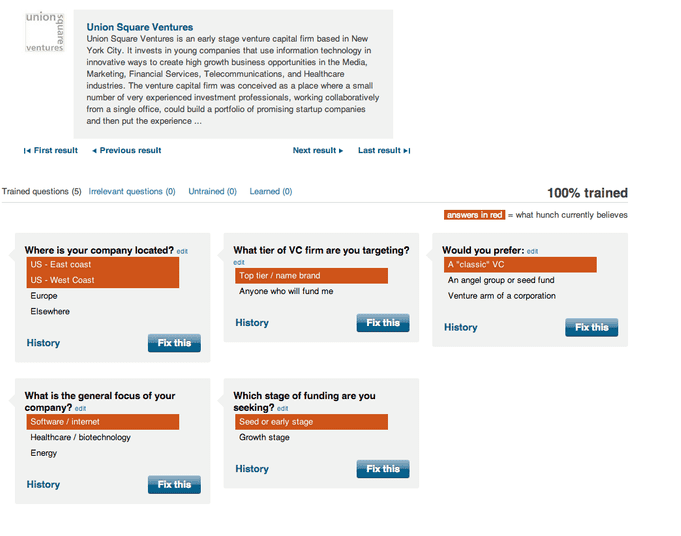

In addition, the results are all “trained” to be associated with responses to questions – meaning users have taught Hunch what to “believe” about each of the firms. For example, in red is what Hunch believes about Union Square Ventures:

Users who find mistakes can just click and fix them, similar to how you fix things on Wikipedia.

So if you see anything missing or that you’d like to change, feel free to do so. I was one main people who worked on this particular topic so it is biased toward my tastes (e.g. Hunch’s own VCs – Bessemer and General Catalyst – rank extremely high).

If you don’t like Hunch’s Q&A process you can jump directly to the See All page, and then using the filters on the left to drill down.

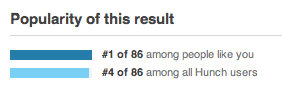

If you are not logged into Hunch, the VC firms you see will be ranked by their popularity amongst all Hunch users. Hunch personalizes the rankings specifically for you if you create an account and answer what we call “Teach Hunch About You” questions. For example, when I am logged in and go to the Hunch page for Bessemer I see this on the right sidebar:

Meaning that Hunch has learned to statistically correlate the questions I’ve answered about myself with liking Bessemer. At this point Hunch has statistically significant data (over 40M user feedbacks total) in most of our ~5000 topics so it usually works really well.